Universal Refill Purple, the colorful hygiene bag for your washroom

The popular Universal Refill is now available in a modern violet color. The unique color is not only visually appealing, but also offers a practical advantage.

Why violet?

The choice of color for hygiene products is more than just an aesthetic decision. The modern purple of the new Universal Refills not only ensures an attractive appearance in any washroom, but also fulfills a practical function. The special color significantly reduces any signs of use. The purple hygiene bags also bring a breath of fresh air into any washroom.

Maximum compatibility

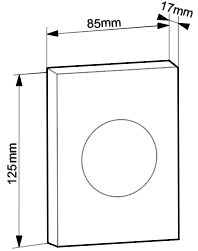

Thanks to the standard size of 125 x 85 x 17mm, the purple refills fit easily into

our Universal feminine hygiene dispensers and many other dispensers on the market. No need to worry about the fit, because the Universal Refills Purple are a practical and modern solution for almost any washroom.

The new hygiene bags are available in practical boxes of 10 and 30 bags in our online store!